Common Mistakes & Considerations for First-Time Homebuyers

1. Skipping the Budget Blueprint

Develop a detailed budget that covers the purchase price and potential hidden costs. Utilise online budgeting tools and consult with a financial advisor to ensure accuracy. Consider creating a contingency fund to cover unexpected expenses, providing a financial safety net throughout the home buying.

2. Overlooking Credit Health

Beyond checking your credit score, actively work on improving it. Pay off outstanding debts, correct any errors on your credit report, and avoid opening new lines of credit before applying for a mortgage. A higher credit score increases your chances of loan approval and opens doors to more favourable interest rates.

3. Location Oversight

Create a checklist of your lifestyle priorities and match them with potential neighbourhoods. Explore local amenities, schools, and public transportation options. Attend community events or join online forums to get firsthand insights from residents. Consider the area’s potential for growth or decline, ensuring your chosen location aligns with your long-term goals.

4. Foregoing Professional Guidance

Tap into the expertise of real estate professionals early in the process. A skilled real estate agent can provide market insights, negotiate on your behalf, and guide you through the complexities of property transactions. A conveyance ensures the legality of the process, reviewing contracts and handling the intricacies of property transfer.

5. Underestimating Hidden Costs

Create a comprehensive checklist of potential hidden costs, including property taxes, insurance, and maintenance. Get professional quotes for services like property inspections and legal assistance to budget more accurately. Having a clear understanding of these costs helps you set realistic financial expectations and avoid financial strain.

6. Rushing the Inspection Process

Attend the home inspection to actively engage with the inspector and gain a firsthand understanding of the property’s condition. Prioritise critical areas like the roof, plumbing, and electrical systems. Use the inspection report as a negotiating tool, addressing necessary repairs before finalising the purchase. A thorough inspection ensures you invest in a home with fewer surprises.

7. Neglecting Loan Pre-Approval

Beyond getting pre-approved, understand the different types of mortgages available. Compare interest rates, loan terms, and closing costs from multiple lenders. Use online mortgage calculators to estimate monthly payments and evaluate various scenarios. A well-researched approach ensures you secure the most favourable mortgage terms for your financial situation.

8. Overstretching Finances

Calculate your debt-to-income ratio and set a realistic budget for your monthly mortgage payment. Consider potential expenses and ensure your home purchase aligns with your financial goals. Aim for a comfortable balance that allows you to enjoy homeownership without compromising your financial well-being.

9. Ignoring Resale Potential

Research the historical resale values of properties in your chosen area. Consider the property’s unique features and potential for improvement. Engage with local real estate agents to gain insights into market trends and property appreciation. Viewing your home as a long-term investment ensures its value grows over time.

10. Forgetting About Future Needs

Anticipate potential lifestyle changes and choose a home that accommodates them. Consider factors like flexible floor plans, proximity to family-friendly amenities, and the potential for future renovations. Prioritise homes with versatile spaces that can adapt to your evolving needs, ensuring your investment remains relevant over the years.

11. Lack of Legal Understanding

Work closely with a conveyance to understand every aspect of the legal process. Clarify any legal jargon in contracts and ensure you know your rights and responsibilities. Use this opportunity to ask questions about local regulations and potential legal implications. A thorough legal understanding safeguards your interests and ensures a seamless transition to homeownership.

12. Lack of Emergency Fund

Establishing an emergency fund specifically for homeownership is crucial. This fund should cover unexpected repairs, appliance replacements, or financial setbacks. Aim for at least three to six months’ worth of living expenses set aside to ensure you’re financially prepared for unforeseen circumstances without derailing your homeownership journey.

13. Overlooking Homeownership Education

Invest time in educating yourself about the homeownership process. Attend workshops, webinars, or seminars offered by reputable sources. Understanding the intricacies of the market, mortgage options, and legal aspects empowers you to make informed decisions throughout the journey.

14. Disregarding Energy Efficiency

Consider the long-term savings associated with energy-efficient homes. Look for properties with updated insulation, energy-efficient appliances, and eco-friendly features. While these may involve a slightly higher upfront cost, the potential for reduced utility bills can contribute significantly to your financial well-being in the long run.

15. Falling for Market Trends

Avoid being swayed solely by current market trends. While it’s essential to be aware of market conditions, prioritise properties that align with your needs and financial goals. Don’t succumb to external pressures or rush into a decision based solely on perceived market momentum.

16. Neglecting Future Investment Potential

Consider the potential for your home as an investment. Explore the neighbourhood’s development plans, infrastructure projects, and overall growth potential. A property in an area with future economic development may offer increased property value over time, contributing to your overall financial portfolio.

17. Disregarding Maintenance Costs

Factor in ongoing maintenance costs when budgeting for homeownership. Regular upkeep is essential to preserve the value of your investment. Create a maintenance schedule and allocate funds for routine tasks such as lawn care, HVAC system checks, and other preventive measures. This proactive approach can save you from costly repairs in the future.

Wrapping Up

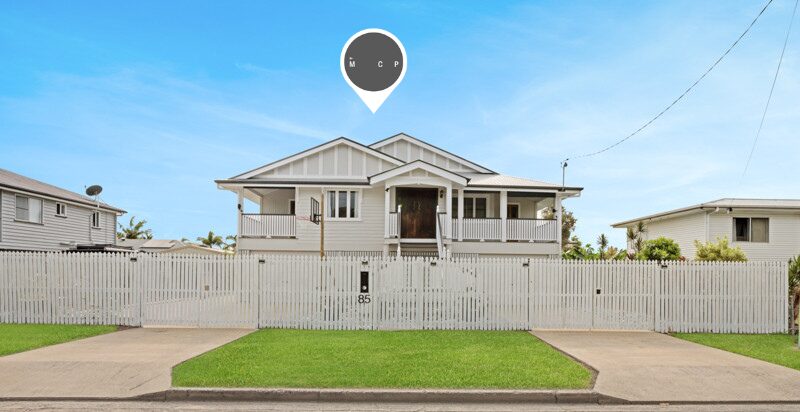

Buying your first home is a big deal, and Mackay City Property is here to make it easy for you. Our guide covers everything you need to know, from budgeting to understanding neighbourhoods. We want to help you avoid common mistakes and make smart choices.

Our team is committed to making your journey to homeownership smooth and stress-free. Your dream home is waiting, and we’re ready to help you open the door to a new chapter in your life.

Disclaimer: The information provided on this blog is intended for general informational purposes only. While we strive to present information in good faith, we do not consider specific situations, facts, or circumstances. Therefore, we make no representation or warranty, whether express or implied, regarding the accuracy, adequacy, reliability, validity, availability, or completeness of the information presented.

This blog may include links to external sites or content from third parties. We do not investigate or monitor such external links for accuracy, adequacy, validity, reliability, availability, or completeness. Consequently, we cannot be held liable or responsible for any information contained therein.